How To Maximize Credit Card Points For Free Hotel Stays

How to Maximize Credit Card Points for Free Hotel Stays unfolds the journey of travelers seeking unforgettable experiences without the burden of accommodation costs. Imagine enjoying luxurious hotel stays while only using points earned through everyday purchases. This guide reveals the secrets of effectively accumulating and utilizing credit card points, ensuring that your next adventure becomes a reality without straining your budget.

With a clear understanding of credit card points, the right card selection, and effective strategies, anyone can turn their spending into valuable hotel stays. This exploration will equip you with the knowledge to navigate the world of travel rewards, giving you the tools to enjoy remarkable getaways with ease.

Understanding Credit Card Points

Credit card points serve as a form of reward currency offered by credit issuers, primarily aimed at incentivizing card usage. They accumulate based on a variety of spending habits, allowing cardholders to earn benefits such as free hotel stays, flights, and other travel-related perks. Understanding how these points work is essential for maximizing their potential.Credit card points can vary significantly among different issuers and rewards programs.

Some common types of points include cashback, travel points, and flexible points that can be transferred to travel partners. Each type has its unique structure and purpose, affecting how they can be utilized for travel rewards. Knowing the specifics of each type can help you make informed decisions regarding which cards to use for your purchases.

Types of Credit Card Points

Understanding the different categories of credit card points can greatly influence your travel rewards strategy. Here are the main types of credit card points:

- Cashback Points: These points are straightforward as they offer a percentage of your spending back as cash. They can be used to lower your credit card balance or be redeemed in various ways, like statement credits.

- Travel Points: Specific to travel rewards, these points are typically earned by using travel-related credit cards. They can often be redeemed for flights, hotel stays, or vacation packages.

- Flexible Points: These points provide the most versatility, allowing you to transfer them to various travel partners, such as airlines or hotel loyalty programs. This flexibility can maximize the value of your points.

Calculation of Points

Credit card issuers calculate points based on your spending in different categories. Points are often awarded as a set number per dollar spent, and some cards offer bonus points for specific categories like dining, groceries, or travel. The calculations usually follow a simple formula:

Points Earned = Amount Spent x Points per Dollar for Category

For instance, if you have a card that offers 2 points per dollar on travel expenses and you spend $500 on travel in a month, you would earn 1,000 points for that month. Understanding these calculations allows you to choose the right card for your spending habits, ensuring you maximize your point accumulation effectively.

Choosing the Right Credit Card

Source: fastly.net

Selecting the right credit card is essential for maximizing the benefits of points accumulation, especially when it comes to free hotel stays. A well-chosen card can enhance your travel experiences without straining your finances. Understanding the features that set different cards apart will empower you to make an informed decision.When evaluating credit cards for points accumulation, several key features should be at the forefront of your considerations.

These include the points earning rate, the types of rewards offered, and the flexibility in redeeming points. Travel credit cards often come with bonus points for specific categories like hotel stays and flights, while general-purpose rewards cards provide a broader range of earning opportunities across various purchases.

Key Features for Points Accumulation

Understanding the major features can help you choose a card that aligns best with your travel goals. Here are some factors to consider:

- Points Earning Rate: Look for a card that offers higher points for travel-related purchases. For instance, some cards provide 3X points on hotel bookings, which can significantly boost your points balance.

- Sign-Up Bonuses: Many credit cards offer attractive sign-up bonuses that can increase your points quickly. For example, earning 50,000 points after spending a certain amount in the first three months can lead to substantial hotel stays.

- Redemption Options: Ensure the card provides flexible redemption options for points. Not all cards allow you to use points for hotel stays, so check the specific terms before applying.

- Foreign Transaction Fees: If you travel internationally, opting for a card with no foreign transaction fees is crucial. This can save you money while earning points abroad.

Comparing Travel Credit Cards and General-Purpose Rewards Cards

There are two primary categories of credit cards to consider when aiming for maximum points: travel credit cards and general-purpose rewards cards. Each has its strengths that cater to different spending habits and travel patterns.Travel credit cards are specifically designed for travelers, offering exclusive perks such as complimentary hotel nights, priority boarding, and access to airport lounges. These cards often have partnerships with hotel chains, allowing you to earn points more quickly when booking stays directly with them.On the other hand, general-purpose rewards cards provide a more versatile approach.

They allow you to earn points on a wider array of purchases, making them a good fit for those who may not travel frequently but still want to earn rewards.

Travel credit cards often provide significant bonuses on travel-related purchases, while general-purpose cards offer flexibility.

Importance of Annual Fees

Understanding the relationship between annual fees and points earned is crucial in your credit card selection process. While some cards charge annual fees, they often compensate for this cost with higher earning rates and valuable perks.When assessing the value of a card with an annual fee, consider the following:

- Calculate Potential Earnings: Determine how many points you could realistically earn in a year based on your spending habits. If the rewards exceed the fee, the card may be worth it.

- Assess Additional Benefits: Evaluate the benefits associated with the card. Perks such as free hotel nights, travel insurance, and concierge services can significantly enhance the card’s value.

- Trial Periods: Some cards offer the first year with no annual fee. This allows you to experience the benefits without commitment, making it easier to gauge its worth.

Strategies to Maximize Points Accumulation

Maximizing credit card points requires a strategic approach that combines understanding sign-up offers, leveraging spending categories, and managing multiple cards. By implementing these strategies, cardholders can enhance their rewards and make the most of their spending.

Bonus Points Through Sign-Up Offers

Sign-up bonuses are one of the most effective ways to accumulate points quickly. Many credit cards offer substantial one-time bonuses that can significantly boost your points balance. These bonuses often require a minimum spending threshold within the first few months of account opening.Consider the following strategies to take full advantage of these offers:

- Research multiple credit cards to find those with the most attractive sign-up bonuses, especially during promotional periods.

- Evaluate the spending requirements and ensure they align with your regular expenses to avoid unnecessary spending.

- Plan major purchases or upcoming expenses, such as travel or home improvements, to coincide with the time frame for meeting the minimum spend.

“A well-timed sign-up can lead to thousands of points that can be redeemed for free hotel stays.”

Impact of Spending Categories on Point Accumulation

Credit cards often categorize spending into specific groups, such as dining, groceries, travel, and gas. Each category typically earns points at different rates. Understanding these categories can help optimize earning potential.To maximize points through spending categories, consider the following:

- Identify which categories earn the most points for your lifestyle and spending habits.

- Utilize cards that offer higher rewards rates in your most frequent spending categories. For example, if you dine out often, a card that offers 3x points on dining can significantly increase your points accumulation.

- Keep track of promotional offers that may provide bonus points in certain categories during specific periods.

“Choosing the right card for each category can multiply your rewards exponentially.”

Using Multiple Credit Cards for Maximum Rewards

Strategically using multiple credit cards can lead to higher points accumulation, as different cards often provide various benefits and rewards structures. By combining these benefits, cardholders can create a tailored approach to their spending.Here’s how to effectively manage multiple credit cards:

- Create a list of your credit cards along with their rewards categories and benefits.

- Use a dedicated card for specific major purchases to ensure you maximize points in the applicable category.

- Regularly assess your cards to determine if there are better options for your spending habits or if you should close cards that no longer offer competitive rewards.

“Maximizing rewards is about strategy, not just spending.”

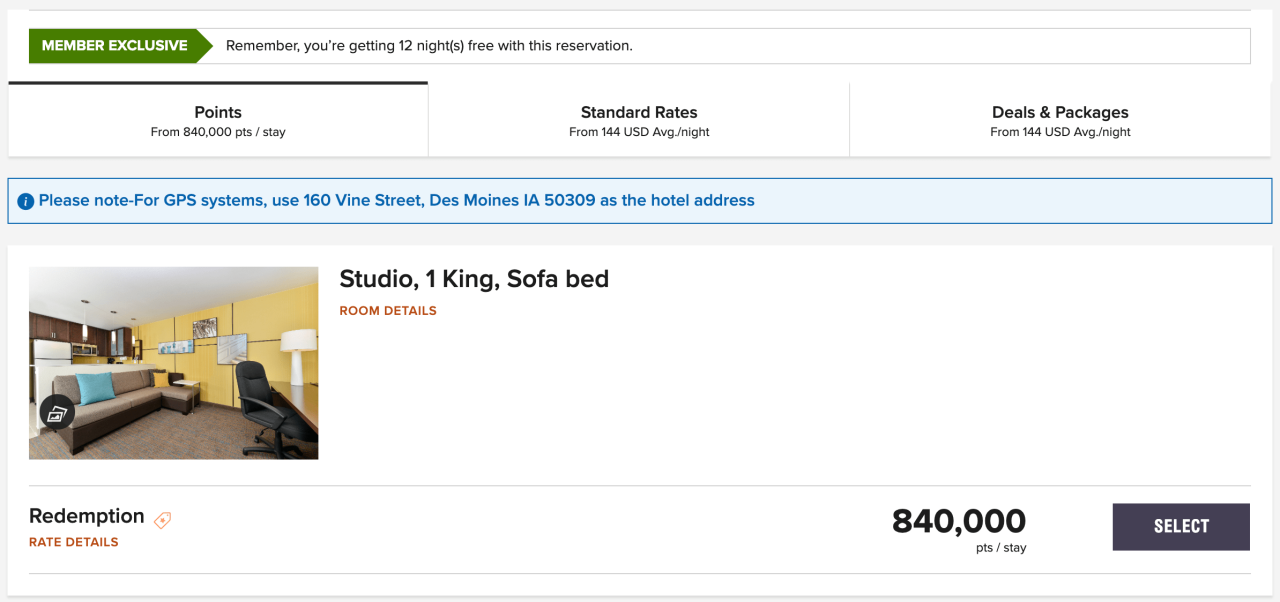

Utilizing Points for Hotel Stays

Source: squarespace-cdn.com

Maximizing credit card points can lead to unforgettable hotel experiences without the financial burden. Understanding how to transfer your points to hotel loyalty programs is essential in transforming those points into tangible benefits. This section will guide you through the process, ensuring that your points are put to the best possible use.Transferring points to hotel loyalty programs is a straightforward process that allows you to leverage your credit card rewards for free or discounted hotel stays.

Most credit card issuers have partnerships with various hotel chains, enabling you to transfer your points directly into hotel loyalty accounts. This often includes a favorable transfer ratio, making it beneficial to research where your points will go the furthest.

Hotel Chains Offering Point Redemption Options

Many major hotel chains provide opportunities to redeem points for free stays, allowing you to enjoy luxurious accommodations without the hefty price tag. Below is a list of notable hotel chains that offer point redemption options:

- Marriott Bonvoy

- Hilton Honors

- World of Hyatt

- IHG Rewards Club

- Radisson Rewards

- Wyndham Rewards

These hotel chains not only provide diverse options in different locations but also have various redemption levels depending on the season, room type, and other factors.Booking hotel stays using credit card points typically involves a few simple steps. First, check your credit card issuer’s website or mobile app to see the transfer ratios and available hotel partners. Once you’ve identified the hotel chain where you want to stay, log into your loyalty account on their website.

Next, initiate the transfer of points from your credit card account to the hotel loyalty account. This process can usually be completed in real-time, although some transfers may take a few days to reflect. After the points have been successfully transferred, search for available bookings on the hotel’s website. Pay attention to blackout dates or promotional offers that may provide additional savings.

“Transforming points into memorable hotel stays is not just about the destination, but the experiences you create along the way.”

Once you’ve selected your hotel, proceed to book your stay using the points. Some hotel chains may offer a ‘Pay with Points’ option, allowing you to cover part of your stay with points and the remainder with cash. This flexibility can make it easier to take advantage of special deals or promotions.By effectively utilizing your credit card points, you can create unforgettable travel experiences without the added expense, making every journey a little more magical.

Timing and Promotions for Point Redemption

Unlocking the potential of your credit card points often hinges on the timing of when you redeem them. Being strategic about your redemption can lead to extraordinary savings and unforgettable experiences. Understanding when and how to leverage seasonal promotions and events can enhance the value of your hard-earned points.The best times to redeem points often align with periods of lower demand for hotel stays or during promotional events.

Knowing these peak and off-peak travel seasons will help you plan your redemption effectively. Additionally, many credit card issuers offer limited-time promotions that can significantly boost the value of your points when redeemed for hotel stays.

Best Times to Redeem Points

Maximizing the value of your points is greatly influenced by timing. Here are some optimal times to consider for redemption:

- Off-Peak Seasons: Travel during off-peak times, such as mid-January to March or late September to early November, often results in lower point requirements for hotel bookings.

- Major Holidays: While redeeming during holidays may require more points, many hotels offer special promotions that can offset this increase in demand.

- Last-Minute Deals: Occasionally, hotels will offer last-minute discounts, allowing you to use fewer points for a stay. Keep a close eye on these opportunities.

Seasonal Promotions and Events

Seasonal promotions can dramatically affect point values. Major events like Black Friday or Cyber Monday often see credit card companies offering additional points or bonuses for certain types of redemptions. Recognizing these events can lead to significant benefits.

- Spring and Summer Promotions: Many hotels offer spring and summer deals, especially for family-friendly destinations, which can provide great value if you book during these periods.

- Year-End Promotions: As the year winds down, many programs offer bonuses for redeeming points, encouraging members to use their accumulated points before year-end.

- Special Events: Events such as Valentine’s Day or New Year’s Eve can lead to unique promotions. Hotels may offer bonus points for romantic getaways or special packages that enhance the value of your stay.

Tracking Limited-Time Offers

Staying organized and informed about limited-time offers is crucial for point redemption success. A proactive approach can help you seize opportunities as they arise.

- Subscription Alerts: Sign up for notifications from your credit card issuer and hotel loyalty programs. Many programs provide email alerts about upcoming promotions and limited-time offers.

- Mobile Apps: Use mobile apps to track your points and stay updated on flash sales or time-sensitive promotions directly from your phone.

- Social Media: Follow your favorite hotel brands and credit card companies on social media to catch exclusive deals and real-time announcements.

Managing Points Effectively

Keeping track of credit card points can feel overwhelming, especially if you hold multiple cards. However, establishing a structured system can help streamline this process, making it easier to maximize your rewards. Effective management of your points not only allows you to take full advantage of the benefits offered by your cards but also ensures that you don’t lose out on valuable rewards.

Creating a Tracking System

Developing a tracking system is crucial for managing your credit card points effectively. This involves consolidating information about the points you earn, the cards you use, and your overall rewards strategy.

- Use a spreadsheet to document your point balances, transaction dates, and any relevant notes. Include columns for each credit card, the points earned, and expiration dates.

- Consider setting reminders on your phone or calendar for when to check your points or when to use them before they expire. This proactive approach helps you stay on top of your rewards.

- Designate a specific day each month to review your points and adjust your spending strategy as needed. Keeping consistent track can reveal trends in earning and spending.

Importance of Tracking Expiration Dates

Many credit card rewards have expiration dates that can catch you off guard if you’re not mindful. Understanding the timelines associated with your points is essential for effective management.

“Many rewards points can expire after a period of inactivity, so staying informed about expiration dates ensures you never lose out on your hard-earned rewards.”

Utilizing your points before they expire can lead to significant savings on hotel stays and travel expenses. Setting alerts for expiration dates encourages you to plan trips or redeem points in advance, ensuring you make the most of your accumulated rewards.

Tools and Apps for Managing Credit Card Points

Several tools and apps can assist you in managing your credit card points effectively. These platforms often offer features that simplify tracking and maximizing your rewards.

- Mint: This budgeting app can help you monitor your credit card points alongside your finances. You can set reminders for point expiration and monitor rewards trends with ease.

- AwardWallet: Specifically designed for tracking loyalty rewards, this app consolidates your points balances from various programs, allowing you to view them in one place.

- Pointimize: Ideal for credit card enthusiasts, this tool helps optimize your credit card usage based on your spending habits to maximize point earnings.

By leveraging these tools, you can streamline the management of your credit card points, making it easier to plan your rewards strategy and ensuring that you take advantage of every opportunity to save on travel expenses.

Avoiding Common Pitfalls

When it comes to maximizing credit card points for free hotel stays, understanding and navigating the common pitfalls is crucial. Many individuals unknowingly sabotage their reward potential, leading to missed opportunities and unnecessary fees. By being aware of these mistakes, you can effectively accumulate points and enjoy the travel perks you desire.One frequent misstep in accumulating credit card points is the failure to pay off the balance each month.

Carrying a balance incurs interest, which can quickly negate any rewards earned. Additionally, not taking full advantage of promotional offers or bonus categories can hinder your accumulation efforts. It’s essential to stay informed about your card’s benefits and utilize them accordingly.

Frequent Mistakes to Avoid

Several common mistakes can significantly impact your ability to accumulate credit card points efficiently. Recognizing these errors can help you make informed decisions and enhance your rewards journey.

- Neglecting Payment Timeliness: Late payments can lead to penalties and a negative impact on your credit score, which may limit your future reward opportunities.

- Exceeding Credit Limits: Going over your credit limit can incur fees and hurt your credit score, affecting your chances of obtaining cards with better rewards.

- Ignoring Annual Fees: Some credit cards come with hefty annual fees, which can outweigh the benefits if you don’t use the card enough to justify the cost.

- Failing to Redeem Points: Letting your points expire or accumulating them without a plan can result in lost rewards that could have been used for free hotel stays.

- Mixing Personal and Business Expenses: This can complicate tracking points and may lead to losing out on benefits designed for specific spending categories.

Red Flags in Credit Card Usage

Monitoring your credit card usage is vital to ensure you are on the right track for accumulating points. Certain behaviors can serve as red flags, indicating that you might be hindering your rewards potential.

- High Utilization Rate: Using more than 30% of your available credit can negatively impact your credit score, making it harder to qualify for cards with better benefits.

- Frequent Applications for New Credit: Applying for multiple cards in a short period can lower your credit score and raise concerns for lenders.

- Ignoring Credit Reports: Failing to regularly check your credit reports can lead to undetected issues that may affect your rewards applications.

Impact of Credit Scores on Reward Opportunities

Your credit score plays a pivotal role in determining your access to premium credit card rewards. High credit scores often qualify you for cards with better point accumulation rates and bonus incentives.A strong credit score can lead to benefits such as higher credit limits, lower interest rates, and exclusive promotions that enhance your earning potential. Conversely, a low credit score can restrict your options, making it challenging to find cards that offer desirable rewards.

“Maintaining a healthy credit score is not just about borrowing—it’s about unlocking the full potential of rewards and experiences.”

Being aware of these common pitfalls, red flags in credit card usage, and the impact of credit scores will empower you to navigate the world of credit card points more effectively. By avoiding these missteps, you can enhance your ability to earn and redeem points for memorable hotel stays.

Real-Life Examples of Maximizing Points

Source: boardingarea.com

Many travelers have discovered the art of maximizing credit card points, transforming mundane spending into extraordinary experiences. These success stories highlight the power of strategic planning and informed choices when it comes to accumulating points and redeeming them for unforgettable vacations.One inspiring case study features a couple, Sarah and Tom, who meticulously planned a two-week vacation in Europe. By leveraging their credit card points, they managed to cover their entire hotel expenses, allowing them to focus on enjoying their journey rather than stressing over costs.

They used a combination of sign-up bonuses, everyday spending, and targeted promotions to amass enough points for their hotel stays in Paris, Rome, and Barcelona.

Lessons from Successful Travelers

The experiences of travelers like Sarah and Tom provide valuable insights into effective point maximization strategies. Here are some key dos and don’ts based on real experiences:

- Do utilize sign-up bonuses: Many credit cards offer substantial point bonuses for new users who meet initial spending requirements. This can jumpstart your points accumulation.

- Do track spending categories: Focus on credit cards that offer higher points for the categories where you spend the most, such as dining or travel.

- Do stay informed about promotions: Regularly check for limited-time offers that provide extra points on certain purchases or during specific periods.

- Don’t overlook annual fees: Weigh the benefits of a credit card against its annual fee to ensure it aligns with your spending habits.

- Don’t let points expire: Keep an eye on expiration dates and use points before they become inactive, especially if you have not used the card in a while.

- Don’t go overboard with credit: Multiple credit cards can be beneficial, but opening too many accounts at once can impact your credit score negatively.

These real-life examples and lessons illustrate how anyone can turn everyday purchases into remarkable travel experiences with the right approach to credit card points.

Outcome Summary

In conclusion, maximizing credit card points for free hotel stays is not just about luck; it’s about informed choices and strategic planning. By understanding how points work and employing the right methods to earn and redeem them, you can open the door to exciting travel opportunities. Remember, every small purchase can be a step toward your next getaway, making the journey just as rewarding as the destination.

FAQ

How do I know if my credit card offers travel rewards?

Check your card’s terms and conditions or visit the issuer’s website to see if it includes travel rewards programs.

Can I combine points from different cards?

Generally, points from different credit card issuers cannot be combined, but you can transfer points to loyalty programs that accept them.

What happens to my points if I close my credit card?

Most credit card points will be forfeited if the account is closed, so be sure to use them before closing a card.

Are there expiration dates for credit card points?

Yes, many credit card points have expiration dates, so it’s important to keep track of them to avoid losing value.

What is the best time to redeem points for hotel stays?

Redeeming points during off-peak seasons or during promotional offers often yields the best value for hotel stays.